Automating Your Savings: Easy Steps to Build Wealth Without Thinking

Automating Your Savings: Easy Steps to Build Wealth Without Thinking

In today's fast-paced world, building wealth can feel like a daunting task, often pushed to the bottom of our to-do lists. However, automating your savings is one of the most powerful and underutilized strategies to secure your financial future. This approach removes the guesswork and the need for constant decision-making, transforming saving into an effortless habit. By setting up a "set-it-and-forget-it" system, you can steadily accumulate funds for emergencies, investments, and long-term goals without even noticing the money leave your account. It's about making your money work for you, consistently and reliably.

This guide will walk you through the simple yet effective steps to implement automated financial planning, ensuring you can build wealth effortlessly and achieve true financial security. We'll explore practical methods, modern tools, and insights to help you establish a robust system for passive wealth accumulation.

Key Points for Automated Savings:

- Effortless Wealth Building: Set up recurring transfers to save without daily effort.

- Removes Decision Fatigue: Eliminates the mental struggle of deciding when and how much to save.

- Consistent Growth: Ensures regular contributions, leveraging compound interest over time.

- Builds Financial Security: Creates a robust emergency fund and investment portfolio.

- Leverages Modern Tools: Utilizes banking features and fintech apps for seamless automation.

The Power of Automation in Building Wealth

The concept of automating your savings isn't just a convenience; it's a fundamental shift in how you manage your money. Many people struggle with saving because it requires consistent discipline and conscious effort. When payday hits, it's easy to get sidetracked by immediate expenses. Automation bypasses this human tendency entirely, ensuring a portion of your income goes directly towards your financial goals before you even have a chance to spend it. This 'pay yourself first' mentality is a cornerstone of sound financial management.

This proactive approach significantly reduces the psychological burden of saving. Instead of relying on willpower, you rely on systems. Over time, these consistent, automatic contributions compound, leading to substantial growth. A study published in late 2023 by a leading financial advisory firm indicated that individuals who consistently automated their savings were 2.5 times more likely to reach their retirement goals compared to those who relied on manual transfers. This highlights the profound impact of consistency over sporadic, larger contributions.

Why "Set It and Forget It" Works for Financial Security

The "set it and forget it" method is particularly effective for building financial security because it capitalizes on inertia. Once established, these automated transfers continue without further intervention. This means you're continuously building your emergency fund, contributing to retirement, and funding investments, even when your attention is elsewhere. It protects you from impulsive spending and ensures long-term financial health. The peace of mind from steadily growing savings is invaluable.

Easy Steps to Automate Your Savings and Build Wealth Effortlessly

Setting up an automated savings system is simpler than you might think. Here’s a step-by-step guide to get you started on your journey to effortless wealth building:

1. Define Your Financial Goals and Priorities

Before you can automate, know what you're saving for. Are you building an emergency fund, saving for a down payment, or planning for retirement? Clearly defining these goals helps determine how much to save and where to direct transfers. For example, an emergency fund needs a high-yield savings account, while retirement savings go into a Roth IRA or 401(k). This is a key step for effective automated financial planning.

- Short-term goals (1-3 years): Emergency fund, vacation, new gadget.

- Mid-term goals (3-10 years): Down payment, car, child's education.

- Long-term goals (10+ years): Retirement, significant investments.

2. Create a Realistic Budget

Understanding your income and expenses is crucial. A budget reveals where money goes, identifying areas to free up funds for savings. Track spending for a month using apps or online tools. Identify non-essential expenses you can reduce to allocate more towards automated savings. This involves conscious choices for greater financial freedom.

3. Choose the Right Accounts for Your Goals

Different goals require different accounts. For an emergency fund, a separate high-yield savings account is ideal, accessible but distinct. Retirement needs 401(k), 403(b), or IRA for tax advantages. Investment goals suit brokerage accounts for stocks or mutual funds. Dedicated accounts for each goal help visualize progress and prevent commingling funds.

4. Set Up Automated Transfers

This is the core of automating your savings. Most banks offer free automated transfer services. Direct deposit allows you to split your paycheck directly into savings or investments, often the most effective method. Set up recurring transfers from checking to savings/investment accounts immediately after payday. Round-up apps like Acorns also transfer spare change, contributing to passive income strategies.

5. Review and Adjust Regularly

While "set it and forget it," regular review is essential. Annually, or with income/expense changes, review your budget, goals, and transfer amounts. When you get a raise or pay off debt, automatically increase savings contributions. Many experts suggest saving half of any pay raise. This ensures your automated system remains optimized and helps you continue building wealth effortlessly.

Differentiated Insights: Modern Tools and Behavioral Science for Savings

Beyond traditional bank transfers, modern fintech innovations offer unique ways to enhance your automated savings. Apps like "Qapital" allow you to set "Rules" that trigger savings based on everyday actions – like saving $5 every time you go to the gym, or rounding up purchases. This gamification leverages behavioral economics to make saving feel less like a chore and more like a rewarding game, a key differentiator from standard advice.

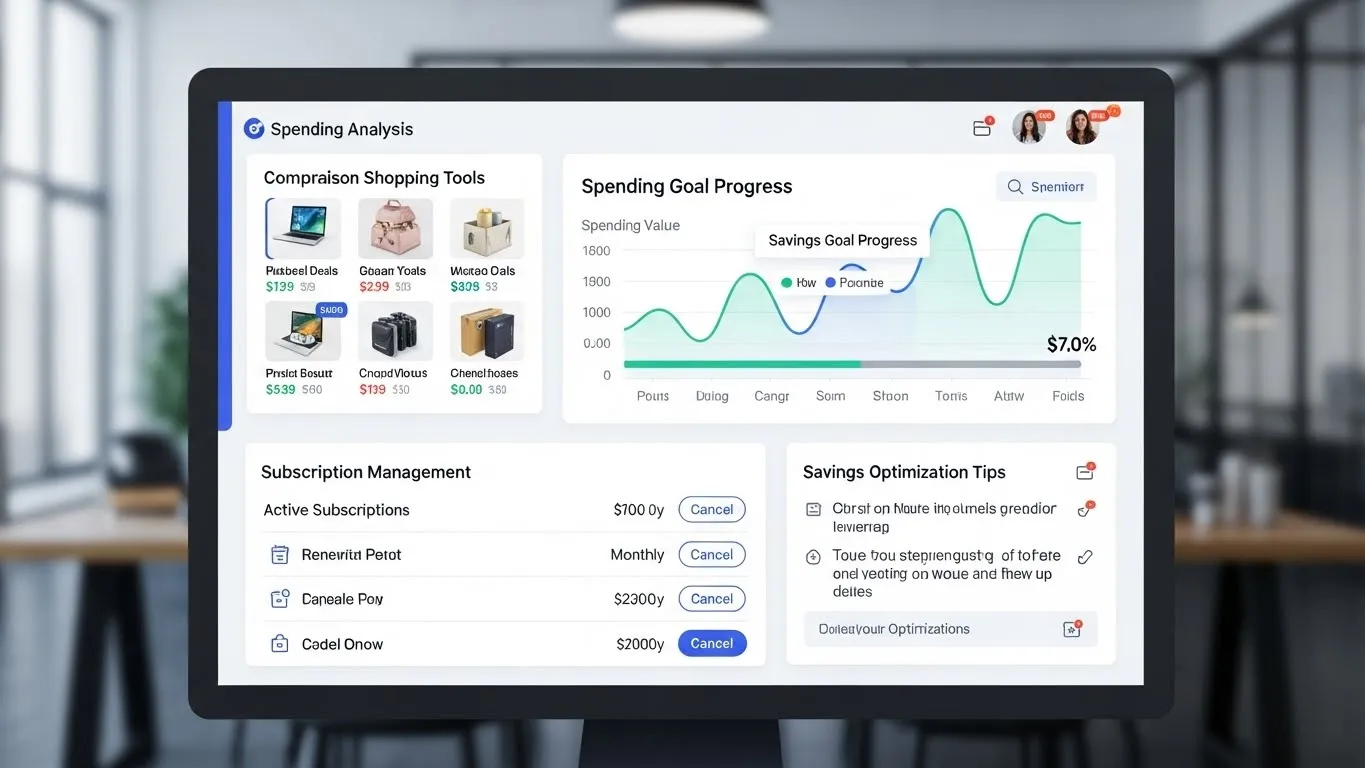

Furthermore, integrating your automated savings with a holistic financial dashboard, such as those offered by Mint or Personal Capital, provides a clearer, consolidated view of your entire financial picture. This allows for more informed adjustments and helps you see the cumulative impact of your automated efforts across all accounts, from your emergency fund to your long-term investments. Data from a 2024 consumer finance survey revealed that users who leveraged integrated financial dashboards for automation reported a 15% higher satisfaction with their savings progress.

Frequently Asked Questions About Automating Your Savings

Q: Why is automating my savings better than manual saving?

A: Automating your savings removes the need for conscious effort and decision-making, common pitfalls for inconsistent saving. By setting recurring transfers, money consistently goes towards your financial goals before you can spend it. This 'pay yourself first' method builds discipline, significantly increasing your success in reaching financial milestones without relying on willpower. It's a highly effective strategy for long-term financial security.

Q: How much should I automate for savings?

A: The 50/30/20 rule suggests 20% of income for savings and debt. However, your ideal amount depends on your situation and goals. Start comfortably, even with $25-$50 per paycheck; consistency is key. As income grows, gradually increase contributions to accelerate wealth building. Prioritizing regular, even small, contributions builds a strong foundation.

Q: What if I don't have much money to save right now?

A: Even small amounts significantly impact, especially when consistently automated. Focus on finding $10 or $20 weekly to start. Utilize round-up apps that save spare change, making saving almost imperceptible. As you pay off debt or reduce expenses, more funds become available. The most crucial step is to begin somewhere and cultivate the habit of regular saving.

Q: Can I easily stop or change my automated transfers?

A: Yes, you have full control over your automated transfers. Most financial institutions allow easy modification, pausing, or cancellation through their online banking or mobile app. There are typically no penalties for adjusting your plan. While consistency is beneficial, you can adapt your savings strategy to accommodate unexpected life changes or evolving financial priorities, ensuring flexibility.

Take the First Step Towards Effortless Financial Freedom

Automating your savings is not just a financial strategy; it's a commitment to your future self. By implementing these easy steps, you can remove the stress and friction traditionally associated with saving, allowing you to build wealth effortlessly and achieve true financial security. Start today by setting up just one automated transfer, even a small one.

Ready to transform your financial future? Take action now! Share your automated savings strategies in the comments below, or subscribe to our newsletter for more expert tips on passive income strategies and building long-term wealth.

Extended Reading and Future Topics:

- Category: Emergency Fund Building (For further insights into securing your financial safety net)

- Related Article: Understanding the Power of Compound Interest (Discover how your automated savings grow exponentially)

- Related Article: Choosing the Right Savings Account (Learn to select accounts that maximize your returns)

Scalability Notes for Future Updates:

- Advanced Automation Strategies for Investments: Delve deeper into automating investments beyond basic transfers, exploring robo-advisors and recurring investment plans.

- Leveraging Fintech for Specific Savings Goals: Focus on niche apps and tools designed for specific goals like travel funds, house down payments, or educational savings.

- The Psychology of Automated Saving: Explore the behavioral science behind why automation works so well and how to combat common financial biases.