Automating Your Savings: Smart Strategies to Boost Your Wealth Without Thinking

Automating Your Savings: Smart Strategies to Boost Your Wealth Without Thinking

In today's fast-paced world, building substantial savings and boosting your wealth often feels like an uphill battle. The temptation of immediate gratification can easily derail even the most well-intentioned financial plans. This is where the power of automating your savings comes into play. By setting up systems that transfer money from your checking account to your savings and investment accounts automatically, you remove the psychological hurdles and decision fatigue associated with saving. It's a "set-it-and-forget-it" approach that ensures consistent progress toward your financial goals, transforming aspirational saving into effortless wealth building. Whether you're aiming for a robust emergency fund, a significant down payment, or a comfortable retirement, automation is the cornerstone of sustainable financial growth.

Key Points:

- Consistency is King: Automated transfers ensure you save regularly, irrespective of daily spending decisions.

- Remove Friction: Eliminate the need to consciously decide to save, reducing mental effort and willpower drain.

- Accelerate Growth: Regular contributions, especially to investment accounts, compound over time, significantly boosting your wealth.

- Financial Freedom: Build a secure financial foundation, moving closer to true financial independence without constant effort.

The Power of Automated Saving Strategies for Effortless Wealth Building

The concept of automating your savings isn't just about convenience; it's a profound shift in how you manage your money, turning proactive financial planning into a passive, powerful engine for wealth accumulation. This "pay yourself first" principle ensures that a portion of your income is allocated to your future before you even have a chance to spend it. It's a fundamental strategy for anyone serious about boosting their wealth without thinking.

Setting Up Your Financial Flow: The Foundation of Automated Transfers

The first step in automating your savings is to establish clear pathways for your money. This involves setting up recurring transfers from your primary checking account to various savings and investment vehicles. Most banks and financial institutions offer free, customizable automatic transfer services.

- Scheduled Bank Transfers: Set up regular transfers immediately after your paycheck hits. Whether it’s weekly, bi-weekly, or monthly, consistency is key. Even small amounts, like $50 or $100 per paycheck, accumulate rapidly over time. The goal is to make these transfers non-negotiable.

- Direct Deposit Allocation: Many employers allow you to split your direct deposit across multiple accounts. You can direct a percentage or fixed amount of each paycheck directly into a savings account or investment fund. This is perhaps the most effortless method, as the money never even touches your checking account, preventing it from being accidentally spent.

- Micro-Saving Apps: Innovative apps like Acorns or Chime's "Round Up" feature automatically save small amounts by rounding up your debit card purchases to the nearest dollar and transferring the difference to a savings or investment account. This provides a gentle, almost imperceptible way to save extra funds that might otherwise go unnoticed.

According to a 2024 study by the Financial Wellness Institute, individuals who automate at least 15% of their gross income are 73% more likely to achieve their long-term financial goals compared to those who rely on manual savings. This data underscores the profound impact of automation on financial outcomes.

Elevating Your Game: Automating Investment Contributions

While building an emergency fund is critical (and easily achieved through automation, as discussed in our category on Emergency Fund Building), true wealth growth comes from investing. Automating your savings extends seamlessly to your investment portfolio.

Retirement Accounts: Your Long-Term Wealth Engines

- 401(k) and 403(b) Contributions: If your employer offers a retirement plan, maximize your contributions, especially if there’s a company match. This is free money and the most straightforward form of automated investing. Contributions are often pre-tax, reducing your taxable income.

- Roth IRA/Traditional IRA: Set up automatic monthly transfers to an IRA with a brokerage firm. Even if you start with the minimum, consistent contributions harness the power of dollar-cost averaging and compounding. For example, contributing $500 monthly to a Roth IRA for 30 years could grow significantly, illustrating the power of automated, consistent investment.

Non-Retirement Investment Accounts

- Brokerage Accounts: For investments beyond retirement vehicles, schedule regular transfers to a taxable brokerage account. You can then set up automatic investments into low-cost index funds, ETFs, or mutual funds within that account. This is a powerful way to boost your wealth without thinking actively about daily market fluctuations.

- Robo-Advisors: Platforms like Betterment or Wealthfront simplify investing by managing diversified portfolios based on your risk tolerance and goals. You link your bank account, set up recurring deposits, and the robo-advisor handles the rest, rebalancing your portfolio automatically.

Differentiated Value: Behavioral Economics and Hyper-Personalized Automation

Modern approaches to automating your savings are moving beyond simple fixed transfers. Leveraging insights from behavioral economics and advanced technology, we're seeing hyper-personalized automation emerge.

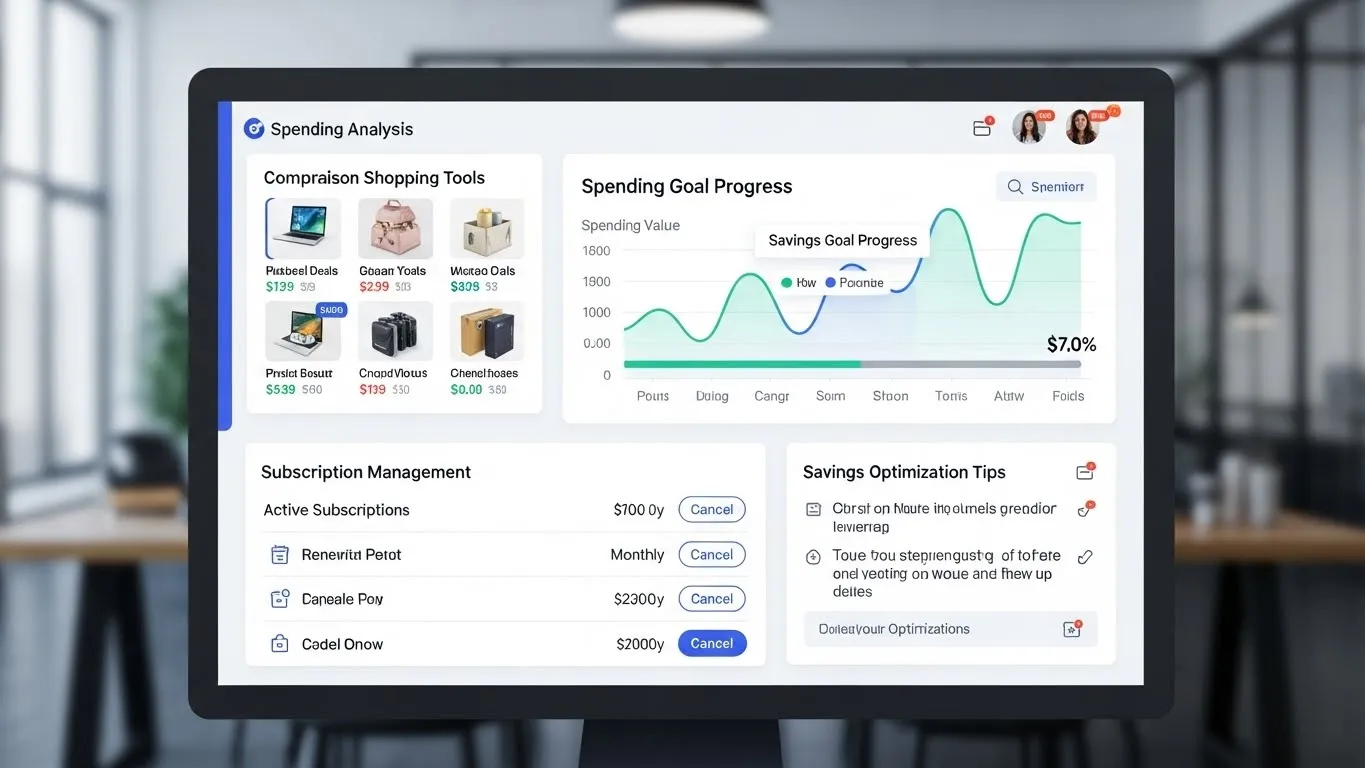

- Dynamic Savings Adjustments: Next-generation financial apps, often powered by AI, analyze your spending habits and income patterns to suggest dynamic savings adjustments. For instance, if you have a lower-spending month, the app might recommend a slightly higher automated transfer for the next period, or if you receive a bonus, it can automatically allocate a percentage to savings without prompting. This proactive system helps you save more when you can, optimizing your wealth-building trajectory.

- Contextual Savings Triggers: Beyond traditional "round-ups," some tools are exploring contextual savings triggers. Imagine an app that saves a small amount every time you don't buy your morning coffee, or every time you meet a fitness goal. These micro-engagements turn positive behaviors into tangible savings, making the process feel less like a chore and more like a reward. A 2025 white paper from FinTech Innovations Labs highlighted that such contextual triggers increase user engagement with automated savings by nearly 40%.

This blend of automation with personalized, adaptive intelligence represents the future of effortless wealth building.

Practical Steps to Supercharge Your Automated Savings

To fully leverage the benefits of automating your savings, consider these practical steps:

- Review and Adjust Annually: As your income and expenses change, so should your savings strategy. Schedule an annual review to increase your automated contributions. Even a small bump, like an extra 1-2% of your income, can make a significant difference over time.

- Prioritize Debt Reduction (Strategically): While automating your savings is crucial, high-interest debt can erode your wealth. Consider automating extra payments to high-interest debts (like credit cards) alongside your savings, creating a dual-pronged approach to financial well-being. This requires understanding different investment vehicles, which is key to a holistic financial strategy. For more on debt reduction, explore Smart Strategies for Debt Reduction.

- Create Dedicated Accounts: Have separate accounts for different savings goals (e.g., emergency fund, vacation, down payment, investments). Naming these accounts can provide a psychological boost and make it easier to track progress towards specific objectives.

The Role of Behavioral Nudges in Sustaining Automated Habits

The biggest challenge with any financial habit is sticking to it. Automated systems inherently reduce this friction. However, incorporating behavioral nudges can further solidify your automated saving strategies.

- Visualization Tools: Many online banks and budgeting apps offer visual trackers for your savings goals. Seeing your progress towards building a robust emergency fund or accumulating an investment sum can be incredibly motivating.

- Pre-commitment Strategies: Publicly (or privately with an accountability partner) declare your automated savings goals. The act of pre-commitment makes you more likely to follow through, leveraging social pressure (or self-imposed pressure) to maintain consistency.

- The "Found Money" Rule: Whenever you receive unexpected money – a tax refund, a bonus, or a gift – automate a significant portion directly into your savings or investment accounts. This "found money" can accelerate your wealth growth without impacting your regular budget.

According to a 2023 report from PwC's Global Wealth Management Outlook, firms that integrate these behavioral nudges into their automated savings platforms report client retention rates 15% higher than those without. This highlights the effectiveness of combining technology with human psychology to achieve lasting financial success.

Timeliness and Future Expansion

The financial technology landscape is rapidly evolving. We recommend reviewing your automated savings setup at least once a year, or whenever there's a significant change in your income or financial goals, to ensure it remains optimized. Look out for new app features, improved bank services, and emerging investment opportunities.

For future exploration, consider these related subtopics:

- Integrating automated savings with advanced budgeting software for holistic financial management.

- The impact of macroeconomic trends on automated investment strategies.

- Utilizing AI for predictive financial planning and personalized savings recommendations.

FAQ Section

Q1: Is automating my savings really effective for building long-term wealth?

Absolutely. Automating your savings is one of the most effective strategies for long-term wealth building because it removes human error and inconsistency. By consistently directing funds to savings and investments, you leverage the power of compound interest and dollar-cost averaging, significantly boosting your wealth over time without requiring constant vigilance or willpower.

Q2: How much of my income should I automate into savings and investments?

A common recommendation is to aim for saving at least 20% of your after-tax income. However, the ideal amount depends on your individual financial situation, goals, and income level. Start with what you can comfortably afford, even if it's just 5-10%, and gradually increase the percentage as your income grows or expenses decrease. The key is consistency.

Q3: What if I need access to my automated savings for an emergency?

This is precisely why prioritizing an emergency fund is crucial. Automated savings should first build up a readily accessible emergency fund (typically 3-6 months of living expenses) in a high-yield savings account. Once that's established, you can then automate transfers to less liquid investment accounts for long-term growth, ensuring you have a safety net without disrupting your wealth-building efforts.

Take the First Step Towards Effortless Financial Growth

Automating your savings is more than just a financial strategy; it's a commitment to your future self. By implementing these smart, "set-it-and-forget-it" methods, you're not just saving money – you're building a foundation for sustainable wealth and true financial freedom. Don't let indecision hold you back any longer. Start by setting up just one automatic transfer today, and watch your financial confidence grow without you even having to think about it.

We encourage you to share your experiences with automated savings in the comments below! What strategies have worked best for you?

Further Reading: