Common Budgeting Mistakes to Avoid: A Beginner's Guide to Financial Success

Embarking on a journey towards financial independence often begins with budgeting. While the concept seems straightforward – spend less than you earn – many find themselves stumbling, making it feel more like a chore than a path to freedom. This guide aims to illuminate the common budgeting mistakes to avoid, offering beginners a clear roadmap to greater financial success. By understanding these pitfalls, you can build a more robust and sustainable financial plan, transforming your relationship with money and propelling you towards your goals.

Effective money management isn't about deprivation; it's about intentionality. This article will help you identify typical errors, provide practical solutions, and equip you with strategies to overcome these challenges. Let's delve into how you can make your budget work for you, not against you, ensuring your financial aspirations become a reality.

Key Points:

- Track Everything: Understand where every dollar goes.

- Be Realistic: Set achievable spending limits.

- Plan for Irregularities: Account for unexpected and annual costs.

- Understand Your "Why": Align spending with personal values.

- Combat Lifestyle Creep: Actively resist increasing expenses with income.

- Review Regularly: Adapt your budget as life changes.

Understanding the Foundation: Why Budgets Fail for Beginners

For many, the idea of budgeting can feel restrictive or overwhelming. The first step toward financial success is often just starting, but without a clear understanding of fundamental principles, even the most enthusiastic beginners can hit roadblocks. A budget isn't just a spreadsheet; it's a living document that reflects your financial life and goals. When it fails, it's rarely the budget's fault itself, but rather a misstep in its creation or application.

One significant reason budgets often fail is a lack of clarity on financial goals. Without a compelling "why"—whether it's saving for a down payment, paying off debt, or building an emergency fund—the motivation to stick to a plan can quickly wane. Another common issue is viewing budgeting as a temporary fix instead of a permanent tool for money management. True financial mastery comes from consistent application and adjustment, not just a one-off effort.

Top Common Budgeting Mistakes to Avoid for Financial Success

Navigating the world of personal finance can be tricky, and even seasoned individuals can fall into traps. For beginners, identifying and circumventing these pitfalls is paramount to achieving financial success. Let's explore the most common budgeting mistakes to avoid and how to tackle them head-on.

Not Tracking Every Expense

One of the most insidious errors is simply not knowing where your money goes. Many individuals track major bills but overlook smaller, everyday expenditures like coffee, snacks, or subscriptions. These "invisible" expenses, often referred to as "leakage," can significantly erode your available funds. Failing to track every dollar makes it impossible to accurately assess your spending habits and identify areas for improvement.

- Solution: For the first month, meticulously track every single expense. Use an app, a spreadsheet, or even a notebook. This deep dive will reveal your true spending patterns. Understanding this foundational element is crucial for effective money management.

Unrealistic Budgeting Expectations

Setting a budget that is too restrictive or unrealistic is a recipe for failure. If you drastically cut back on all discretionary spending overnight, you're likely to feel deprived and abandon the budget altogether. A common mistake is to allocate zero for categories like entertainment or dining out when these are natural parts of your life. This can lead to frustration and a sense of defeat.

- Solution: Be honest about your current spending habits and make gradual adjustments. If you spend $300 on dining out, try to reduce it to $250 next month, not $50. Build in a small "fun money" allowance to prevent burnout and ensure your budget is sustainable.

Forgetting Irregular Expenses

It's easy to budget for monthly bills like rent and utilities, but many beginners overlook irregular or annual expenses. Car insurance premiums, holiday gifts, home maintenance, or even once-a-year software subscriptions can derail a perfectly planned monthly budget if not accounted for. These larger, less frequent costs often lead to unexpected debt or dipping into savings.

- Solution: Create a sinking fund for irregular expenses. List all non-monthly costs you anticipate over a year, sum them up, and divide by 12. Set aside this amount monthly into a separate savings account. This proactive approach smooths out your cash flow and prevents financial surprises.

Ignoring the "Why" Behind Your Spending

Budgeting is more than just numbers; it's about aligning your money with your values. A significant mistake is to focus solely on cutting costs without understanding the underlying reasons for your spending. Are you spending on convenience because you lack time? Or on experiences because you value travel? Understanding your motivations can help you make more conscious and satisfying financial decisions.

- Solution: Reflect on your core values. For instance, if you prioritize financial freedom, every spending decision should ideally align with that goal. This philosophical approach to personal finance can dramatically alter your perspective, as noted by financial psychologists. A study cited in Psychology Today (2024 edition) highlighted that individuals who align spending with core values report higher financial well-being.

Falling Victim to Lifestyle Creep

As your income increases, it's natural to want to enjoy the fruits of your labor. However, a perilous mistake is allowing your expenses to grow proportionally, or even exceed, your rising income. This phenomenon, known as lifestyle creep, prevents you from building wealth despite earning more. What once felt like a luxury becomes a necessity, making it harder to save or invest.

- Solution: When you get a raise or bonus, resist the urge to immediately upgrade your lifestyle. Instead, automatically direct a significant portion (e.g., 50% or more) of the increase towards savings, investments, or debt repayment. This ensures that your wealth grows faster than your desires.

Not Reviewing and Adjusting Your Budget

A budget is not a static document. Life happens: job changes, new family members, unexpected expenses, or shifting financial goals. One of the most critical common budgeting mistakes to avoid is failing to regularly review and adjust your budget. A budget created six months ago might be entirely irrelevant today, leading to frustration and a sense of failure.

- Solution: Schedule a monthly "budget date" with yourself or your partner. Review your spending against your plan, assess your progress towards goals, and make necessary tweaks. This could involve reallocating funds, adjusting category limits, or even completely revamping your approach. A quarterly comprehensive review is also advisable to address larger shifts. This continuous feedback loop is vital for maintaining effective money management. For example, the U.S. Federal Reserve's Survey of Consumer Finances (2022 data released in 2023) consistently shows that households with active financial planning and regular reviews tend to have higher net worths.

Building a Resilient Budget: Strategies for Long-Term Money Management

Beyond avoiding pitfalls, building a truly resilient budget requires proactive strategies. It's about creating a system that can withstand life's curveballs and adapt to your evolving financial landscape.

Automate Your Savings and Bills

One of the most effective strategies is to automate your financial actions. Set up automatic transfers from your checking account to your savings, investment accounts, and even debt repayments immediately after your paycheck arrives. This "pay yourself first" approach ensures that your financial goals are prioritized before discretionary spending begins. It removes the temptation to spend money that should be saved.

Embrace the Zero-Based Budgeting Method

Consider trying a zero-based budget, especially if you struggle with knowing where your money goes. With this method, every dollar of your income is assigned a job – whether it's an expense, savings, or debt repayment – until your income minus your expenses equals zero. This ensures that no money is left unaccounted for and compels you to make intentional decisions with every dollar.

For more detailed guidance on setting up your budget effectively, consider exploring resources on how to create a realistic budget.

Leveraging Modern Tools and Mindsets for Effective Budgeting

The landscape of personal finance has evolved, offering sophisticated tools and fresh perspectives. Differentiating your budgeting approach means tapping into these modern resources and adopting a growth mindset.

Utilize Budgeting Apps and Software

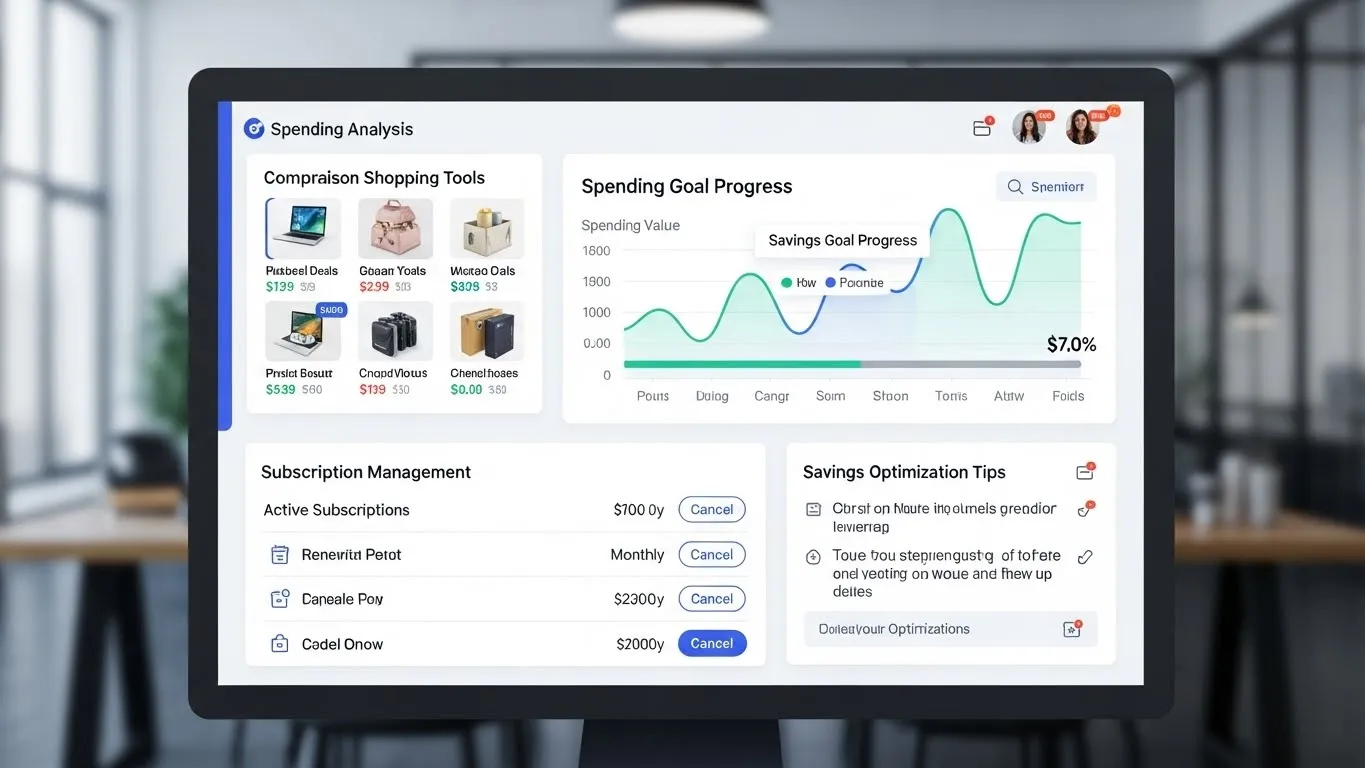

Gone are the days when budgeting was solely a manual chore. Today, numerous apps and software solutions can automate expense tracking, categorize transactions, and visualize your spending. Tools like Mint, YNAB (You Need A Budget), or Personal Capital can link directly to your bank accounts, providing real-time insights into your financial health. These digital assistants can significantly reduce the effort involved in tracking and reviewing, making it easier to stick to your plan. The integration of AI-powered financial tools (a trend highlighted in FinTech Futures 2025 projections) is making budgeting even more intuitive, offering predictive insights and personalized recommendations based on your spending patterns.

Focus on Your Cash Flow, Not Just Your Budget

While a budget outlines future spending, understanding your personal cash flow provides a real-time snapshot of money moving in and out. Many beginners focus too much on the budget plan and too little on the actual flow. Regularly monitoring your cash flow helps you identify discrepancies between your planned budget and your actual spending, allowing for immediate adjustments. This proactive monitoring ensures you catch issues before they snowball into larger financial problems. For a deeper dive into this vital aspect, learn more about /articles/understanding-your-personal-cash-flow.

Budgeting as a Continuous Learning Process

Adopt a mindset that budgeting is an ongoing learning curve, not a fixed solution. Market conditions change, inflation fluctuates (e.g., recent inflation trends discussed by economists in The Wall Street Journal in 2024), and your personal circumstances will evolve. Be open to experimenting with different budgeting methods, adapting to new financial technologies, and continually educating yourself on personal finance best practices. This flexibility is key to long-term financial resilience.

Frequently Asked Questions

What is the most common budgeting mistake beginners make?

The most common mistake beginners make is not tracking every expense. Many people only track major bills, overlooking small, daily transactions like coffee or subscriptions. These seemingly insignificant costs, often called "money leaks," accumulate quickly and can severely undermine a budget. Accurate tracking is the foundation of understanding your true spending habits.

How often should I review my budget?

You should aim to review your budget monthly. This allows you to compare your actual spending against your planned budget, identify any discrepancies, and make necessary adjustments for the upcoming month. Additionally, a more comprehensive review should be conducted quarterly or annually to account for larger changes in income, expenses, or financial goals.

What if I keep overspending in my budget categories?

If you consistently overspend in certain categories, it's a sign that your budget might be unrealistic or your spending habits need closer examination. Instead of feeling defeated, adjust your budget by reallocating funds from less critical areas or finding ways to reduce spending in the problem category. This might involve finding cheaper alternatives, cutting back temporarily, or increasing the budget for that category if it's truly essential and sustainable.

Can budgeting truly help me achieve financial independence?

Yes, budgeting is a foundational pillar for achieving financial independence. By providing a clear picture of your income and expenses, it empowers you to make intentional decisions about your money. A well-managed budget helps you reduce debt, build savings, invest for the future, and align your spending with your long-term financial goals, ultimately paving the way to financial freedom.

Take Control of Your Financial Future Today

Avoiding these common budgeting mistakes to avoid is more than just good financial hygiene; it's an empowering step towards securing your financial future. By being mindful of where your money goes, setting realistic expectations, planning for the unexpected, and regularly reviewing your plan, you're building a strong foundation for lasting financial success.

Don't let past financial missteps define your future. Start implementing these strategies today, and you'll be well on your way to mastering your money. We encourage you to share your budgeting experiences or questions in the comments below! Your insights could help others on their journey. For more expert tips on managing your finances, explore our other articles in the Budgeting and Expense Tracking category, or delve into essential topics like /articles/how-to-create-a-realistic-budget and /articles/understanding-your-personal-cash-flow to further enhance your financial literacy.

Expandable Subtopics for Future Updates:

- The psychology of saving and spending: Behavioral economics in budgeting.

- Budgeting for different life stages: From students to retirees.

- The role of debt management in a comprehensive budget plan.