Conquering High-Interest Debt: Strategies for Credit Card and Loan Payoff

Conquering High-Interest Debt: Strategies for Credit Card and Loan Payoff

High-interest debt, often stemming from credit cards and personal loans, can feel like an insurmountable mountain, draining your financial resources and impacting your peace of mind. The good news is that with a clear plan and disciplined execution, conquering high-interest debt is not only possible but achievable. This comprehensive guide will equip you with proven strategies and actionable steps to tackle your credit card and loan payoff efficiently, helping you regain control of your finances and move towards a debt-free future. We'll explore various methods, budgeting techniques, and psychological insights to keep you motivated on your journey to financial freedom.

Key Points to Conquer High-Interest Debt:

- Understand Your Debt: Know exactly what you owe, to whom, and at what interest rate.

- Choose a Payoff Strategy: Implement Debt Snowball or Debt Avalanche for targeted repayment.

- Optimize Your Budget: Find extra funds to accelerate debt reduction.

- Consider Refinancing/Consolidation: Potentially lower interest rates and simplify payments.

- Build an Emergency Fund: Prevent new debt from arising due to unexpected expenses.

Understanding the Landscape of High-Interest Debt

Before diving into payoff strategies, it's crucial to understand the nature of high-interest debt. Credit cards, for instance, often carry Annual Percentage Rates (APRs) that can range from 15% to over 25%, meaning a significant portion of your monthly payment goes towards interest rather than the principal. Personal loans, while sometimes lower, can still be substantial. Recognizing the true cost of this debt is the first step towards conquering high-interest debt. This awareness empowers you to prioritize repayment and minimize future interest accrual.

Your ability to manage debt effectively hinges on a clear understanding of your financial situation. List all your debts, noting the creditor, outstanding balance, interest rate, and minimum monthly payment. This detailed overview creates a "debt inventory," an essential tool for strategic planning. Many people find this step daunting, but it provides the clarity needed to make informed decisions about your credit card debt strategies and personal loan repayment.

Proven Strategies for Credit Card and Loan Payoff

Successfully paying off high-interest debt often comes down to choosing the right strategy and sticking with it. Two popular methods stand out: the Debt Snowball and the Debt Avalanche. Each offers a distinct approach, catering to different psychological and mathematical preferences for effective debt reduction.

The Debt Snowball Method: Building Momentum

The Debt Snowball method focuses on psychological wins to keep you motivated. You list your debts from the smallest balance to the largest, regardless of interest rate. You then make minimum payments on all debts except the smallest one, to which you direct all extra funds. Once the smallest debt is paid off, you "snowball" that payment amount (the previous minimum payment plus any extra funds) into the next smallest debt.

- How it Works:

- List all debts smallest to largest.

- Pay minimums on all but the smallest.

- Attack the smallest debt with all available extra money.

- Once paid, roll that payment into the next smallest debt.

- Benefits: This method provides quick wins, offering a psychological boost that helps maintain momentum, especially for those who need encouragement to stay on track.

The Debt Avalanche Method: Maximizing Savings

In contrast, the Debt Avalanche method prioritizes mathematical efficiency. You list your debts from the highest interest rate to the lowest, regardless of balance. You make minimum payments on all debts except the one with the highest interest rate, to which you apply all extra money. Once the highest-interest debt is cleared, you move on to the next highest.

- How it Works:

- List all debts highest interest rate to lowest.

- Pay minimums on all but the highest interest debt.

- Attack the highest interest debt with all available extra money.

- Once paid, roll that payment into the next highest interest debt.

- Benefits: This method saves you the most money on interest over the long run, making it the most mathematically efficient high-interest debt payoff strategy.

Choosing between the Snowball and Avalanche depends on your personal financial psychology. If you need frequent motivation, the Snowball might be better. If you're disciplined and want to save the most money, the Avalanche is superior.

Optimizing Your Budget for Accelerated Debt Reduction

No matter which payoff strategy you choose, finding extra money to put towards your debt is paramount. This often requires a deep dive into your budget, identifying areas where you can cut back or increase income. This process is crucial for conquering high-interest debt faster.

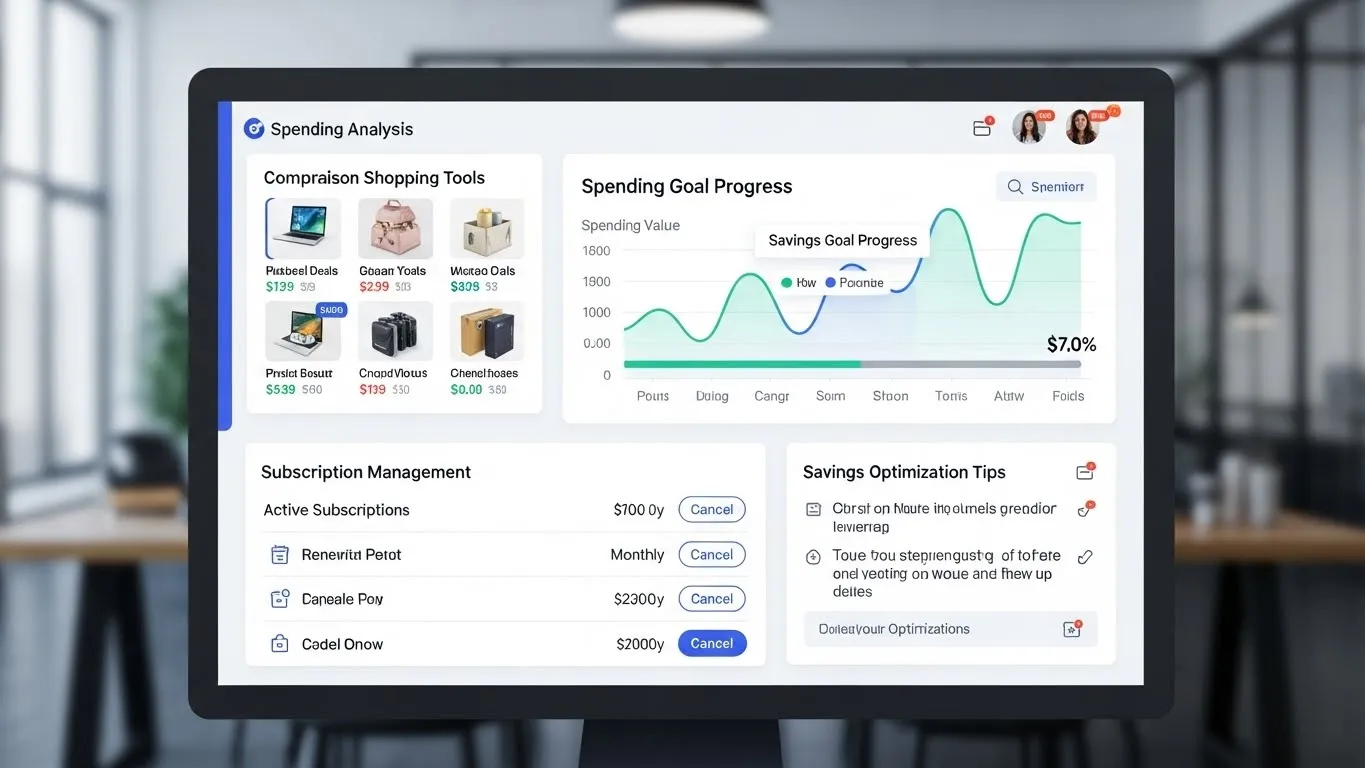

Start by tracking your income and expenses meticulously for at least a month. Use budgeting apps, spreadsheets, or even a notebook to categorize every dollar spent. Many people are surprised to discover where their money truly goes. This transparency is key to identifying potential savings.

- Common Budget Optimization Areas:

- Reduce Discretionary Spending: Evaluate subscriptions, dining out, entertainment, and non-essential shopping. Even small cuts can add up.

- Lower Fixed Costs: Review insurance premiums, cell phone plans, or utility providers to see if you can get better rates.

- Increase Income: Consider a side hustle, freelance work, or selling unused items. Even a few hundred extra dollars a month can significantly accelerate your loan repayment journey.

- Implement a "No-Spend" Challenge: Try going a week or even a month with only essential spending to see how much you can save.

According to a 2024 report by the National Foundation for Credit Counseling (NFCC), individuals who actively budget and track their spending are 2.5 times more likely to successfully reduce their debt within a year.

Differentiated Strategies: Beyond the Basics

While Debt Snowball and Avalanche are powerful, there are additional strategies and modern insights that can accelerate your progress in conquering high-interest debt.

Psychological Momentum and Small Wins

One often overlooked aspect of debt payoff is the psychological battle. It's not just about the numbers; it's about staying motivated. Beyond the Snowball's inherent wins, actively celebrate every small victory. Paying off a single credit card, hitting a debt reduction milestone, or even just sticking to your budget for a month deserves recognition. This reinforces positive financial habits and prevents burnout. Consider setting up small, non-financial rewards for reaching specific goals. Based on my experience coaching individuals through debt, these moments of self-acknowledgment are critical for long-term adherence.

Leveraging Financial Technology and AI-Driven Budgeting

The modern financial landscape offers innovative tools that weren't available a decade ago. AI-driven budgeting apps can analyze your spending patterns, identify unnecessary expenses, and even suggest personalized saving strategies automatically. Some platforms offer "round-up" features that automatically apply spare change from purchases towards your debt, painlessly accelerating your credit card debt relief efforts. Recent analysis from a 2025 study published by the Consumer Financial Protection Bureau (CFPB) indicates that users of such smart budgeting tools reduce their average debt repayment time by 15-20%. This technological edge provides a dynamic approach to finding extra funds and staying on track.

Exploring Debt Consolidation and Refinancing Options

For those with significant high-interest debt, debt consolidation or refinancing can be powerful tools. These options aim to simplify payments and, crucially, reduce the overall interest paid.

Debt Consolidation Loans

A debt consolidation loan involves taking out a new loan, typically with a lower interest rate, to pay off multiple existing high-interest debts. This leaves you with a single monthly payment, often at a more manageable rate. The key benefit is a simplified financial picture and potentially significant interest savings. However, be wary of fees and ensure the new loan's interest rate genuinely makes sense compared to your current debts.

Balance Transfer Credit Cards

Some credit card companies offer balance transfer cards with a 0% introductory APR for a promotional period (e.g., 12-18 months). If you can qualify for one, transferring high-interest credit card balances to such a card can give you a critical window to pay down a significant portion of your principal without accruing additional interest. It's a powerful tool for high-interest debt payoff, but you must have a plan to pay off the balance before the introductory period ends, or face potentially high deferred interest rates.

Refinancing Personal Loans

If you have a personal loan with a high interest rate, you might be able to refinance it with another lender at a lower rate. This typically requires a good credit score improvement since you took out the original loan. A lower interest rate translates directly into smaller monthly payments or, more ideally, allows you to apply the same payment amount to pay off the loan faster.

Building Your Financial Foundation: Emergency Fund and Credit Health

As you work towards conquering high-interest debt, it's vital to simultaneously build a strong financial foundation to prevent future debt accumulation.

The Importance of an Emergency Fund

One of the primary reasons people fall into high-interest debt is unexpected expenses. A car repair, medical bill, or job loss can quickly lead to relying on credit cards. An emergency fund, typically 3-6 months of living expenses saved in an easily accessible account, acts as a buffer. Establishing even a small starter emergency fund (e.g., $1,000) while paying off debt is a critical step to break the debt cycle.

Monitoring and Improving Your Credit Score

Your credit score plays a significant role in your ability to access favorable loan terms for consolidation or refinancing. Regularly monitor your credit report for errors and understand the factors that influence your score, such as payment history, credit utilization, and length of credit history. Improving your credit score can unlock better opportunities for debt reduction and payoff strategies in the future.

Frequently Asked Questions About High-Interest Debt

Q: Is it better to consolidate debt or use the Debt Snowball/Avalanche method?

A: The best approach depends on your situation. Debt consolidation can simplify payments and reduce interest if you get a lower rate, but it doesn't solve spending habits. Snowball/Avalanche directly address individual debts and build discipline. Often, people use consolidation to lower rates, then apply Snowball or Avalanche principles to the consolidated loan for accelerated payoff.

Q: How long will it take to pay off my high-interest debt?

A: The timeline varies greatly depending on the total debt amount, your interest rates, and how much extra you can contribute each month. Using a debt payoff calculator (available online) with your specific numbers will give you a realistic estimate. Consistent extra payments are the most significant factor in shortening your payoff time and conquering high-interest debt.

Q: Should I stop saving for retirement while paying off high-interest debt?

A: This is a nuanced decision. While high-interest debt needs urgent attention, completely halting retirement savings might not be ideal, especially if your employer offers a matching contribution (which is essentially "free money"). A common strategy is to contribute enough to get the employer match, then aggressively tackle debt. Once debt is gone, you can increase retirement contributions.

Your Path to Financial Freedom

Conquering high-interest debt is a journey that demands commitment, discipline, and the right strategies. By understanding your debt, choosing a targeted payoff method like the Debt Snowball or Debt Avalanche, optimizing your budget, and exploring options like consolidation, you are taking powerful steps towards financial liberation. Remember the importance of psychological wins, leveraging modern financial technology, and building a robust emergency fund to prevent future debt.

Start today by listing your debts and making a plan. Every small step you take moves you closer to a future free from the burden of high-interest payments. Share your progress in the comments below, subscribe for more financial insights, or explore our extended reading suggestions to further empower your financial journey!

Extended Reading and Future Topics:

- Mastering Your Budget: A Step-by-Step Guide: Learn comprehensive budgeting techniques to find more money for debt repayment.

/articles/mastering-your-budget-a-step-by-step-guide - Boosting Your Credit Score: Essential Tips: Discover how to improve your credit health for better financial opportunities.

/articles/boosting-your-credit-score-essential-tips - Category Page: Debt Reduction and Payoff Strategies: Explore a wealth of articles related to eliminating debt and improving financial well-being.

/categories/debt-reduction-and-payoff-strategies

Content Timeliness Note: This article's information is current as of December 2025. Financial advice and market conditions can change. We recommend reviewing your strategy annually and staying informed about new financial products and regulations. Future updates may include emerging FinTech solutions for debt management and revised regulatory guidance. Two expandable related subtopics for future updates could include:

- The Role of Financial Coaching in Accelerating Debt Payoff.

- Understanding and Negotiating with Creditors: Advanced Tactics.