Creating a Personalized Debt Reduction Plan: Step-by-Step Guide to Financial Freedom

Embarking on the journey to financial freedom often begins with tackling debt. For many, the idea of debt reduction can feel overwhelming, but with a structured, personalized approach, it's an achievable goal. Creating a personalized debt reduction plan isn't just about paying off balances; it's about reclaiming control of your financial future and building sustainable habits. This comprehensive guide will walk you through every step, from understanding your current financial landscape to implementing effective strategies and maintaining momentum towards a debt-free life. Our aim is to empower you with the knowledge and tools to design a plan that genuinely works for your unique situation.

Key Points for Your Debt Reduction Journey:

- Assess All Debts: Understand what you owe, to whom, and at what interest rate.

- Choose a Strategy: Decide between the debt snowball or debt avalanche method.

- Create a Realistic Budget: Allocate funds specifically for debt repayment.

- Stay Persistent: Monitor progress, adjust as needed, and celebrate milestones.

- Build Financial Resilience: Establish an emergency fund and future savings.

Understanding Your Current Debt Landscape: The First Step to a Personalized Plan

Before you can effectively create a personalized debt reduction plan, you must have a clear, honest picture of your current financial situation. This initial assessment forms the bedrock of your strategy, allowing you to prioritize and allocate resources wisely. Don't shy away from this step; knowledge is power when it comes to debt.

Gathering Your Debt Information

Start by compiling a complete list of all your debts. This includes credit cards, student loans, car loans, mortgages, personal loans, and any other obligations. For each debt, note down crucial details:

- Creditor Name: Who do you owe?

- Current Balance: How much is outstanding?

- Interest Rate (APR): This is critically important as it affects how quickly your debt grows.

- Minimum Payment: What's the smallest amount you must pay monthly?

- Due Date: When is the payment expected?

Organizing this information, perhaps in a simple spreadsheet, will give you a bird's-eye view. According to a 2024 analysis by the Federal Reserve, the average American household holds significant amounts in various types of consumer debt, underscoring the commonality and importance of having a clear strategy.

Analyzing Your Income and Expenses

Once you know what you owe, the next step is to understand what you can afford to pay. This involves creating a detailed budget. Track all your income sources and every single expense for at least a month. Categorize your spending into fixed costs (rent, loan payments) and variable costs (groceries, entertainment). This exercise often reveals areas where you can cut back, freeing up more money for debt repayment. Remember, the goal is to find extra cash to accelerate your debt payoff strategies. If you're struggling to create an effective budget, exploring resources like "Budgeting Basics: How to Create a Sustainable Financial Plan" can provide valuable insights. (Internal link: /articles/budgeting-basics-how-to-create-a-sustainable-financial-plan)

Choosing Your Debt Reduction Strategy: Avalanche vs. Snowball

With a clear financial snapshot, you're ready to select the method that best suits your temperament and financial goals. There are two primary, proven approaches for creating a personalized debt reduction plan: the Debt Avalanche and the Debt Snowball.

The Debt Avalanche Method

The Debt Avalanche method focuses on paying off debts with the highest interest rates first. You make minimum payments on all debts except the one with the highest interest rate, to which you apply any extra funds you have. Once that debt is paid off, you roll the money you were paying on it into the next highest interest rate debt.

- Pros: This method saves you the most money in interest over time, leading to a faster overall debt-free date. It's mathematically the most efficient approach.

- Cons: It can take longer to see individual debts disappear, which might be demotivating for some.

The Debt Snowball Method

The Debt Snowball method prioritizes paying off the smallest debt balances first, regardless of their interest rates. You make minimum payments on all debts except the smallest one, throwing all extra money at it. Once the smallest debt is gone, you take the money you were paying on it and add it to the payment for the next smallest debt.

- Pros: Provides psychological wins quickly as you eliminate entire debts. This momentum can be highly motivating.

- Cons: You might pay more in interest over time compared to the avalanche method, potentially taking longer to reach financial freedom.

The choice depends on whether you prioritize mathematical efficiency or psychological motivation. Many financial experts, including those at the National Foundation for Credit Counseling (NFCC) in late 2023, often advise the avalanche for its long-term savings, but acknowledge the snowball's power for those needing immediate wins.

Building Your Personalized Debt Reduction Plan: Actionable Steps

Once you've chosen your strategy, it's time to build out your specific, actionable personalized debt reduction plan. This involves setting realistic goals and finding ways to free up more money.

Setting Realistic Goals and Timelines

- Define your "why": What motivates you to pay off debt? Financial freedom, a new home, peace of mind? Keeping this front and center will fuel your persistence.

- Set a target debt-free date: While this might adjust, having a goal provides direction.

- Break it down: Instead of one massive goal, set smaller, achievable milestones. "Pay off credit card A by X date," or "Reduce student loan balance by $Y in 6 months."

Finding Extra Money for Debt Repayment

This is where your budget analysis truly shines. Look for opportunities to increase your income or decrease your expenses.

- Cut discretionary spending: Identify non-essential expenses that can be reduced or eliminated (e.g., eating out, subscriptions you don't use).

- Boost your income: Consider a side hustle, selling unused items, or asking for a raise.

- Debt consolidation or refinancing: For high-interest debts like credit cards, consolidating them into a single loan with a lower interest rate can simplify payments and save money. However, always weigh the pros and cons carefully, as discussed in detail in "Understanding the Pros and Cons of Debt Consolidation." (Internal link:

/articles/understanding-the-pros-and-cons-of-debt-consolidation) - Negotiate interest rates: Sometimes, a simple phone call to your credit card company can result in a lower APR, freeing up more of your payment to go towards the principal.

Automating Payments and Tracking Progress

Automation is your friend. Set up automatic payments for at least the minimum amounts to avoid late fees. Then, automate your extra payments towards your chosen target debt. Regularly track your progress – monthly is ideal. Seeing balances shrink is incredibly motivating and helps you stay on track with your debt payoff strategies.

Staying Motivated and Adapting Your Debt Payoff Plan

The path to financial freedom is rarely linear. There will be bumps, unexpected expenses, and moments when motivation wanes. Creating a personalized debt reduction plan also means building in flexibility and a resilient mindset.

Overcoming Challenges and Setbacks

Life happens. An unexpected car repair or medical bill can derail even the best-laid plans. When this occurs:

- Don't give up: A temporary pause or adjustment isn't failure; it's a recalibration.

- Revisit your budget: See if there are temporary cuts you can make to absorb the new expense.

- Adjust your timeline: It's okay if your debt-free date shifts. The important thing is to keep moving forward.

- Build an emergency fund: Even a small emergency fund (e.g., $1,000) can act as a crucial buffer, preventing new debt accumulation when unforeseen events arise.

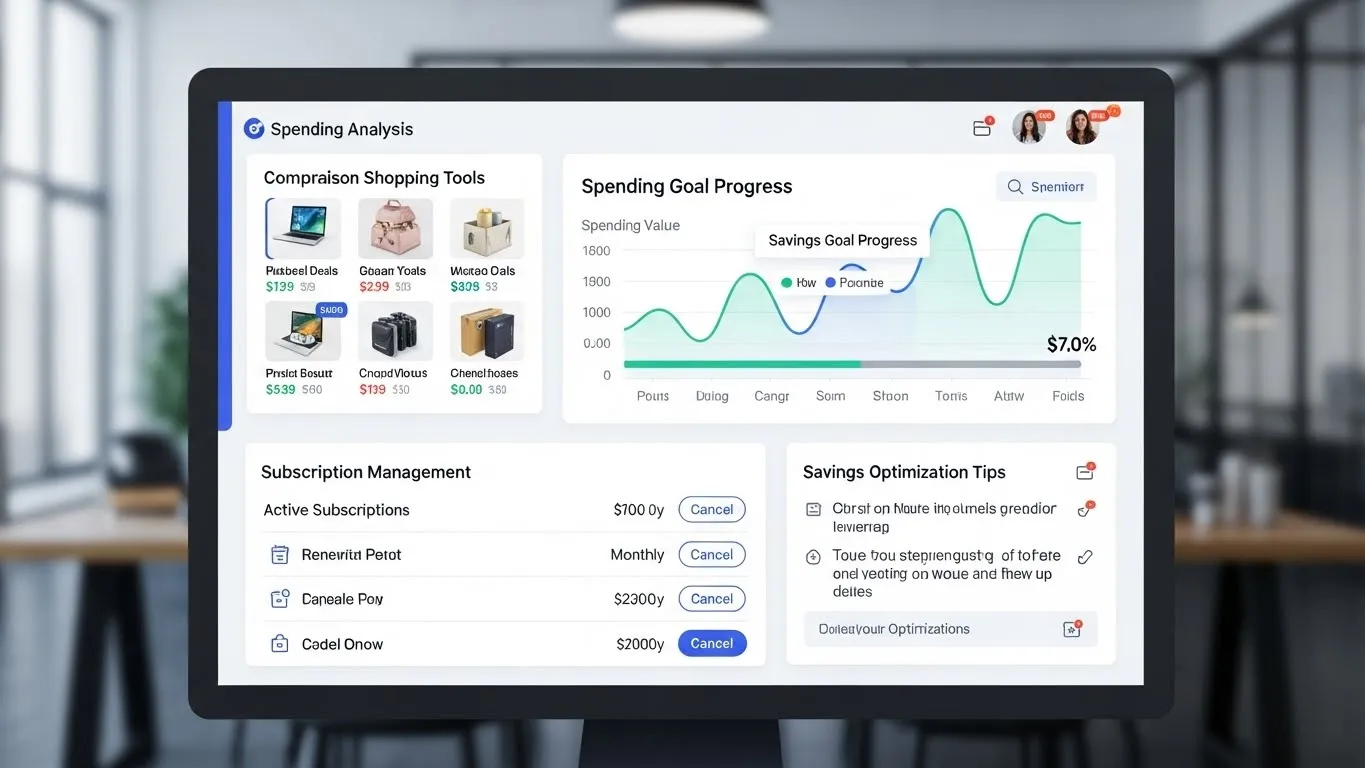

Leveraging Behavioral Finance and Technology

A unique insight for creating a personalized debt reduction plan involves understanding the psychological aspects of money. Celebrate small victories – paying off a credit card or reaching a certain balance reduction. Visualize your debt-free future. Also, consider leveraging modern technology. Many budgeting apps now offer AI-driven insights, personalized spending analysis, and debt tracking features that can keep you engaged and on target. These tools can automate aspects of your plan, sending reminders and showing projections, which can be invaluable for staying committed.

Beyond Debt: Maintaining Financial Freedom

Your journey doesn't end when your last debt is paid off. The final step in creating a personalized debt reduction plan is to establish habits that ensure you stay debt-free and build wealth.

Building Healthy Financial Habits

- Continue budgeting: Keep tracking your income and expenses. This discipline is now geared towards saving and investing.

- Prioritize saving: Boost your emergency fund to 3-6 months of living expenses. Start saving for retirement and other long-term goals.

- Smart use of credit: If you use credit cards, pay them off in full every month to avoid interest. Your credit score will likely be excellent after diligently paying off debt, so maintain it responsibly.

Recommendations for Future Updates:

- Exploring Advanced Debt Strategies: Delve into topics like debt settlement, bankruptcy, and credit counseling in more detail.

- Impact of Economic Trends on Debt: Discuss how inflation, interest rate changes, and recessions affect debt reduction strategies.

- Specific Debt Types: Create guides focused on student loan strategies (refinancing, income-driven repayment) or mortgage payoff tactics.

Remember, the goal is not just to eliminate debt but to cultivate a robust financial foundation for life.

Frequently Asked Questions (FAQ)

What is the fastest way to pay off debt?

The fastest way to pay off debt, purely from a mathematical standpoint, is typically the debt avalanche method, where you focus extra payments on the debt with the highest interest rate first. This minimizes the total interest paid over time. However, the fastest way for you might also depend on your motivation; some find the debt snowball method, paying off smallest balances first, faster psychologically due to quick wins.

How do I start a personalized debt reduction plan?

Starting a personalized debt reduction plan involves three key steps: first, list all your debts with their balances and interest rates; second, create a detailed budget to understand your income and expenses; and third, choose a repayment strategy like the debt avalanche or snowball. From there, set specific goals and actively track your progress.

Is it better to pay off small debts first or high-interest debts?

Choosing between paying off small debts first (debt snowball) or high-interest debts first (debt avalanche) depends on your personal financial psychology. Paying off small debts provides quick motivational wins, while paying off high-interest debts saves you more money in interest over the long run. Both are effective, but one might suit your approach better.

What if I get off track with my debt reduction plan?

It's common to get off track occasionally. Don't be discouraged. Reassess your budget, identify what caused the deviation, and make adjustments to your plan or timeline. Focus on consistent progress rather than perfection. Consider revisiting your motivations and celebrating small victories to regain momentum. An emergency fund can help prevent new debt during setbacks.

Take the First Step Towards Financial Freedom Today!

Creating a personalized debt reduction plan is an empowering journey that puts you firmly in control of your financial destiny. By systematically assessing your debts, choosing the right strategy, and committing to your plan, you can achieve remarkable results. Don't let debt dictate your future; take action now.

Ready to transform your finances? Share your biggest debt challenge in the comments below, or tell us which strategy you're planning to use! For more insightful articles on managing your money, subscribe to our newsletter and explore other topics in our Debt Reduction and Payoff Strategies category. (Internal link: /categories/debt-reduction-and-payoff-strategies) Your journey to financial freedom starts here, one step at a time.