How Much Should Your Emergency Fund Be? Building a Resilient Financial Safety Net for Unexpected Events

Life is full of uncertainties, and while we can't predict every twist and turn, we can certainly prepare for them. A robust emergency fund is your primary defense against unforeseen financial disruptions, acting as a crucial financial safety net for unexpected events. Whether it's a sudden job loss, an urgent medical bill, or an unexpected home repair, having readily accessible savings can prevent minor setbacks from spiraling into major financial crises. This guide will walk you through determining how much your emergency fund should be, helping you build a resilient foundation for your financial future.

Key Points for Building Your Emergency Fund:

- Baseline Goal: Aim for 3-6 months of essential living expenses.

- Personalization: Adjust this goal based on income stability, dependents, and job security.

- Accessibility: Keep funds in a high-yield, easily accessible savings account.

- Gradual Approach: Start small and build your fund steadily over time.

- Regular Review: Reassess and adjust your fund size annually or after major life changes.

Understanding the Importance of Your Emergency Fund

An emergency fund isn't just another savings account; it's a strategic component of sound financial planning. It provides a buffer that protects your long-term investments, prevents you from incurring high-interest debt, and offers immense peace of mind. Without an adequate emergency fund, an unexpected event can force you to make difficult choices, such as liquidating investments prematurely or relying on credit cards, which can derail your financial progress.

Recent economic shifts, including periods of high inflation and job market volatility, underscore the intensified need for a substantial financial safety net. A 2024 study by The Financial Resilience Institute highlighted that households with robust emergency savings reported significantly lower financial stress during unexpected crises, demonstrating the psychological as well as financial benefits. This isn't merely about money; it's about maintaining stability and reducing anxiety during challenging times.

How Much Should Your Emergency Fund Be? The Golden Rule and Beyond

The most common advice from financial experts is to save three to six months' worth of essential living expenses in your emergency fund. This range provides a solid baseline for most individuals and families. However, this is merely a starting point. Your ideal fund size will ultimately depend on your unique personal circumstances, risk tolerance, and lifestyle.

For instance, single-income households, individuals in less stable job sectors, or those with significant health concerns might benefit from aiming for six to twelve months of expenses. Conversely, individuals with highly stable jobs, dual-income households, or minimal fixed expenses might feel comfortable with a fund on the lower end of the range.

Calculating Your Monthly Essential Expenses

Before you can determine how much your emergency fund should be, you need to understand your true monthly essential expenses. This isn't your entire budget, but rather the non-negotiable costs required to maintain your basic living standards.

Here's a breakdown of what to include:

- Housing: Rent or mortgage payments, property taxes, basic utilities (electricity, water, heat).

- Food: Groceries and basic necessities; exclude dining out and luxury food items.

- Transportation: Car payments, insurance, fuel, public transport costs to get to work or essential appointments.

- Insurance Premiums: Health, car, home, or renter's insurance.

- Debt Minimums: Minimum payments on student loans, credit cards, or other necessary debts (though ideally, you'd tackle high-interest debt separately).

- Essential Healthcare: Prescription medications or ongoing medical treatments.

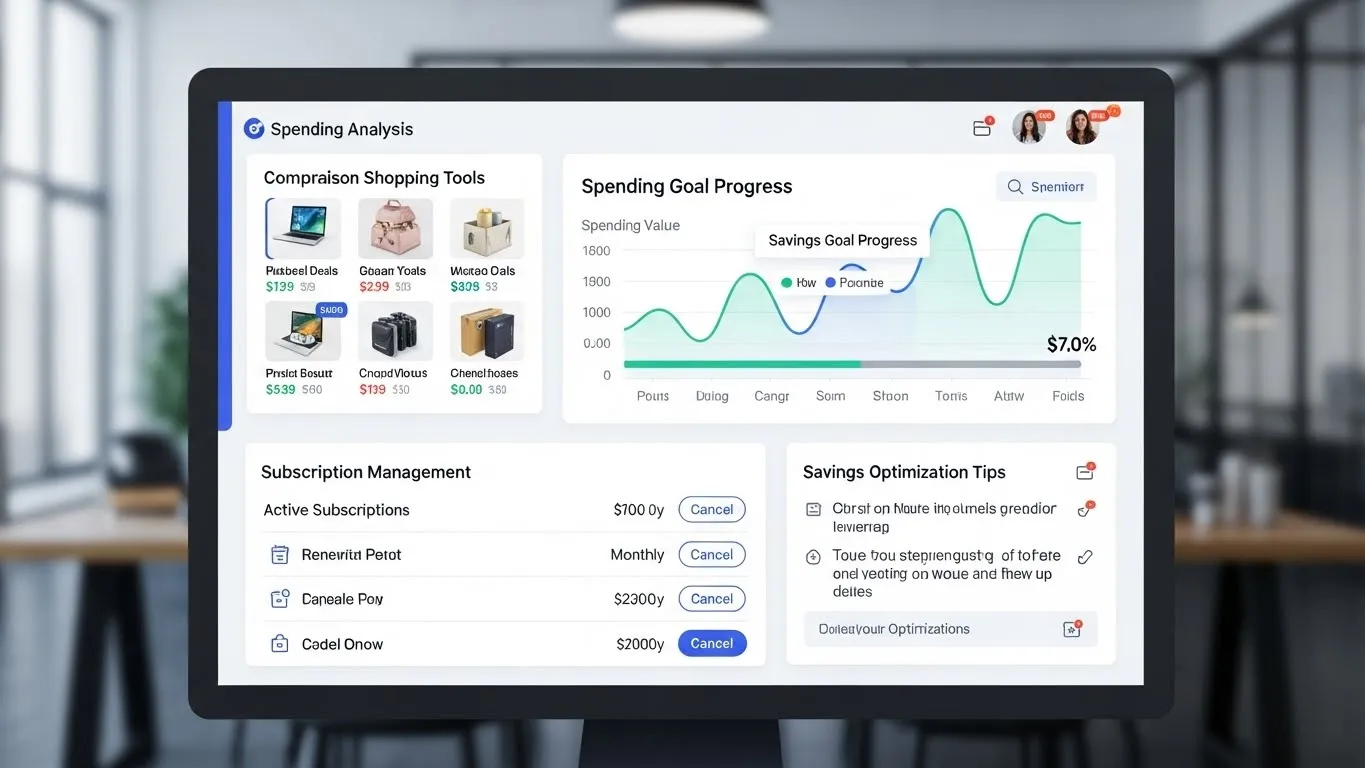

What to exclude: Discretionary spending like entertainment, subscriptions, gym memberships (unless medically necessary), vacations, and non-essential shopping. Focusing on true essentials helps you build a realistic and effective financial safety net. For further guidance on tracking and managing your outflows, consider exploring resources on budgeting for financial freedom.

Factors Influencing Your Ideal Emergency Fund Size

The 3-6 month guideline is excellent, but several personal factors can push your target higher or lower. Tailoring your emergency fund to your specific situation ensures optimal financial security.

- Income Stability: If you have a steady, predictable income (e.g., tenured government job), you might lean towards a smaller fund. If your income is commission-based, freelance, or in a volatile industry, a larger fund provides greater protection.

- Job Security: Are you in a high-demand field or one prone to layoffs? A less secure job market warrants a more substantial financial safety net. According to Q3 2025 data from The Economic Research Bureau, the average duration of unemployment for certain sectors has shown increased variability, emphasizing the need for adaptable emergency funds.

- Dependents: If you have a spouse, children, or elderly parents who rely on your income, your emergency fund needs to be larger to cover their needs during a crisis.

- Health Status & Insurance Coverage: Individuals with chronic health conditions or high-deductible insurance plans should consider a larger fund to cover potential out-of-pocket medical expenses. Experts at The National Financial Planning Association emphasized in a 2023 briefing the critical role of robust health insurance in complementing an emergency fund, especially for unforeseen health emergencies.

- Debt Load: While your emergency fund covers essential expenses, a significant amount of high-interest debt (like credit card debt) can create additional financial strain. Some financial advisors suggest a "baby emergency fund" of $1,000-$2,000 first, then aggressively paying down high-interest debt, and then building a full fund.

- Access to Other Resources: Do you have a secondary income stream, easily accessible investments, or a family support system that could provide temporary assistance? These factors might slightly reduce the urgency for a massive fund, but they shouldn't replace it entirely.

Where to Keep Your Emergency Fund for Optimal Accessibility

The primary characteristics of an emergency fund are safety and liquidity. It needs to be easily accessible without losing value. This means avoiding volatile investments.

- High-Yield Savings Accounts (HYSAs): These are often the best place for your emergency fund. They are FDIC-insured, meaning your money is safe, and they typically offer significantly higher interest rates than traditional savings accounts. This allows your money to grow modestly while remaining liquid. For more insights, explore understanding high yield savings accounts.

- Money Market Accounts: Similar to HYSAs, money market accounts offer higher interest rates than standard savings accounts and often come with check-writing privileges or a debit card, offering slightly more flexibility. They are also FDIC-insured.

- Certificates of Deposit (CDs): While CDs generally offer higher interest rates, they come with penalties for early withdrawal. Some financial experts suggest a "CD laddering" strategy where you stagger CDs with different maturity dates to maintain some liquidity, but for a true emergency, HYSAs are usually preferred due to immediate access.

Avoid keeping your emergency fund in the stock market or other investments that can fluctuate in value. The goal is preservation and accessibility, not growth.

Building Your Emergency Fund: A Step-by-Step Guide

The idea of saving 3-12 months of expenses can feel daunting, but it's entirely achievable with a strategic approach.

- Set a Realistic Goal: Based on your calculated essential expenses and personal factors, establish a clear, achievable target for your emergency fund. Break it down into smaller, manageable milestones.

- Automate Your Savings: Set up an automatic transfer from your checking account to your dedicated emergency fund savings account each payday. Even small, consistent contributions add up significantly over time.

- Cut Unnecessary Expenses: Review your budget meticulously and identify areas where you can reduce spending. Even small cuts, like cancelling unused subscriptions or brewing coffee at home, can free up funds for your emergency savings.

- Boost Your Income: Consider taking on a side hustle, selling unused items, or asking for a raise at work. Any extra income can be directly funneled into your financial safety net, accelerating your progress.

- Monitor and Replenish: Your emergency fund is not a static entity. Review its size annually or whenever you experience a major life change (marriage, new baby, job change, home purchase). If you use funds for an emergency, make replenishing them a top financial priority immediately.

FAQ Section: Common Questions About Emergency Funds

Q: Can I invest my emergency fund for higher returns?

A: Generally, no. The primary goal of an emergency fund is liquidity and safety, not investment growth. Investing your emergency fund in volatile assets like stocks or cryptocurrency exposes it to market fluctuations, meaning your funds could be significantly reduced just when you need them most. Stick to FDIC-insured, easily accessible accounts like high-yield savings accounts.

Q: Should I prioritize paying off debt or building my emergency fund?

A: This is a common dilemma. A balanced approach is often best. Many financial experts recommend building a "mini emergency fund" of $1,000 to $2,000 first. This provides a basic buffer. After that, focus aggressively on paying down high-interest debt (like credit cards). Once that debt is gone, then pivot back to fully funding your complete 3-6 month emergency fund.

Q: How often should I review my emergency fund balance and goal?

A: You should review your emergency fund at least once a year, or whenever you experience a significant life change. Major life events such as getting married, having a child, changing jobs, buying a home, or experiencing a major health event can all alter your essential expenses and risk profile, necessitating an adjustment to your emergency fund goal.

Secure Your Future: Start Building Your Emergency Fund Today

Building a robust emergency fund is one of the most fundamental steps towards achieving financial security and peace of mind. It shields you from life's inevitable curveballs, allowing you to navigate unexpected events without derailing your long-term goals. By understanding how much your emergency fund should be and diligently working towards that goal, you are investing in your future resilience.

Don't wait for a crisis to realize the value of a financial safety net. Start today, even if it's with small, consistent steps. Your future self will thank you.

Ready to take control of your finances? Share your emergency fund goals in the comments below! For more expert insights into building a secure financial future, subscribe to our newsletter and explore our other articles in the Financial Goals and Planning category.