Navigating Your First Job Finances: Essential Money Tips for Young Professionals Starting Out

Navigating Your First Job Finances: Essential Money Tips for Young Professionals Starting Out

Introduction: Mastering Your First Paycheck

Stepping into your first full-time job is an exhilarating milestone, marking a new chapter of independence and responsibility. With your first regular paycheck comes the crucial task of navigating your first job finances. This isn't just about paying bills; it's about laying a strong foundation for future financial stability and freedom. Many young professionals starting out feel overwhelmed by managing their money effectively, from understanding taxes to planning for retirement. However, establishing smart money habits early can significantly impact your long-term wealth and well-being. This guide offers essential money tips designed specifically for young professionals, helping you make informed decisions and build lasting financial health from day one.

Key Points for Young Professionals:

- Create a Realistic Budget: Understand your income and track all your expenses to ensure you live within your means.

- Prioritize Debt Repayment: Tackle high-interest debts like credit cards and student loans aggressively to free up future income.

- Build an Emergency Fund: Aim for 3-6 months of living expenses saved in an easily accessible account for unexpected costs.

- Start Investing Early: Leverage compound interest by contributing to retirement accounts like a 401(k) or Roth IRA.

- Utilize Digital Tools: Embrace modern apps and platforms to automate savings and streamline financial management.

Building a Solid Financial Foundation: Essential Money Tips for Young Professionals

Your journey to financial independence begins with understanding the basics. For young professionals, this means grasping the nuances of your income and diligently managing expenses.

Understanding Your Income and Expenses

Receiving your first salary statement can be surprising, often because the net pay (what you actually receive) is considerably less than your gross pay (your total salary). Deductions for taxes, health insurance, and retirement contributions quickly reduce your take-home amount. Understanding these deductions is the first step in first job financial planning. Once you know your net income, the next critical step is creating a budget. A budget isn't restrictive; it's a roadmap for your money, helping you allocate funds efficiently.

Consider popular budgeting methods like the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. Alternatively, a zero-based budget assigns every dollar a purpose. Whichever method you choose, consistent tracking of your spending is vital for effective young professional money management. This helps identify areas where you can cut back and free up more funds for savings or investments.

Taming the Debt Monster: Student Loans and Credit Cards

Many young professionals enter the workforce carrying student loan debt, and credit cards often become a temptation. Addressing debt head-on is one of the most impactful entry-level salary budgeting strategies. Prioritize paying off high-interest debts first, as these can quickly spiral and erode your financial progress. For student loan repayment for new employees, explore options like income-driven repayment plans if needed, but aim to pay more than the minimum whenever possible.

Building a positive credit score is also essential. Use credit cards responsibly by paying your balance in full each month to avoid interest charges and demonstrate good financial habits. Avoid carrying a balance whenever possible. A strong credit score will be invaluable for future major purchases like a car or a home, making this a crucial aspect of your first job financial planning.

The Power of an Emergency Fund for Young Professionals

Life is unpredictable, and unexpected expenses can quickly derail even the best financial plans. This is where an emergency fund becomes your financial safety net. As a young professional, aim to save at least three to six months' worth of living expenses in an easily accessible, separate savings account. This fund should only be used for true emergencies, such as job loss, medical crises, or unforeseen home/car repairs.

Building this fund should be a top priority after covering essential expenses and minimum debt payments. Automate transfers from your checking account to your emergency fund each payday to make saving consistent and effortless. Having this financial cushion provides immense peace of mind and prevents you from falling into high-interest debt when crises arise, solidifying your young professional money management efforts.

Smart Saving and Investing Strategies for Your First Job Finances

Beyond budgeting and debt management, smart saving and investing are pivotal for long-term wealth creation.

Starting Early: The Magic of Compound Interest

One of the most powerful financial tools at your disposal is compound interest, and its magic is amplified by starting early. Even small, consistent contributions can grow significantly over time. As a young professional, take advantage of employer-sponsored retirement plans like a 401(k) or 403(b), especially if your company offers a matching contribution. This is essentially free money and a guaranteed return on your investment.

Beyond employer plans, consider opening a Roth IRA. Contributions are made with after-tax dollars, meaning qualified withdrawals in retirement are tax-free. For those looking to invest outside of retirement, a traditional brokerage account offers flexibility. Remember, consistency beats timing in investing, so set up automated monthly contributions. This proactive approach to first job financial planning will yield substantial rewards in the future.

Leveraging Digital Tools for Seamless Financial Management

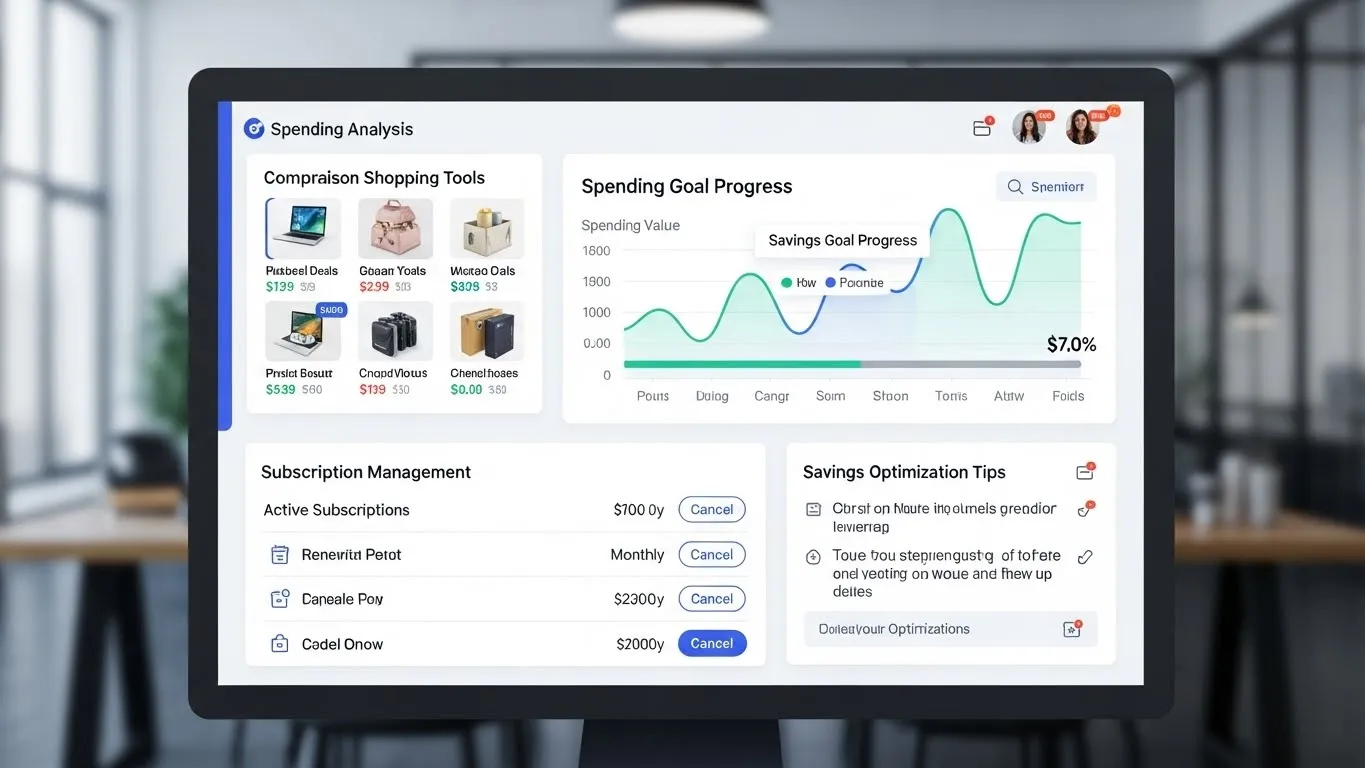

The modern financial landscape offers an array of digital tools that can revolutionize how young professionals manage their money. Budgeting apps like Mint, YNAB, or PocketGuard offer intuitive ways to track spending, categorize transactions, and visualize your financial health in real-time. These tools automate the often-tedious process of manual budgeting.

Investment platforms such as Vanguard, Fidelity, or robo-advisors like Betterment and Acorns simplify investing, making it accessible even for beginners. They allow for automated investing based on your risk tolerance and goals. According to a 2024 report by Deloitte on "The Future of Digital Banking," 78% of Gen Z and Millennials now rely on mobile banking apps for core financial activities, highlighting the trend towards app-driven financial management. Embracing these technologies can significantly enhance your entry-level salary budgeting and overall financial discipline.

Exploring Income Optimization and Side Hustles

While your primary job is your main income source, exploring income optimization and side hustles can significantly accelerate your financial goals. Whether it's paying off student loans faster, boosting your emergency fund, or increasing your investment contributions, a side gig provides extra capital. The gig economy offers numerous opportunities, from freelance writing and graphic design to tutoring or ride-sharing.

Consider skills you already possess or interests you could monetize. A 2023 study published by the Pew Research Center on "Americans and the Gig Economy" found that nearly one-in-six adults have earned money through an online gig platform, with younger adults disproportionately represented. This trend offers a flexible way to supplement your income, allowing you to save more or pay down debt more aggressively without relying solely on your primary salary. This proactive approach is key for navigating your first job finances effectively. For more ideas, explore various income optimization and side hustles in our dedicated category.

Advanced Strategies for Navigating Your First Job Finances

As you settle into your role, delve deeper into your benefits and consider long-term planning.

Understanding Employee Benefits Beyond Salary

Your compensation package extends beyond your base salary. Take time to understand all your employee benefits, which can represent a significant portion of your total compensation. This includes health, dental, and vision insurance options, where understanding deductibles and co-pays is crucial. Many companies offer life insurance, short-term, and long-term disability insurance, which provide vital protection.

Beyond immediate health and security, look into professional development opportunities, tuition reimbursement programs, and employee assistance programs. These benefits can save you money, advance your career, and improve your overall well-being. Maximizing these often-underutilized benefits is a smart move for young professional money management.

Long-Term Financial Planning: Setting Goals and Milestones

Successful financial management is a marathon, not a sprint. Begin by defining your financial goals: short-term (e.g., building an emergency fund, saving for a vacation), mid-term (e.g., down payment for a home, student loan payoff), and long-term (e.g., retirement, financial independence). Regularly review and adjust these goals as your life circumstances change.

While managing your finances independently is empowering, don't shy away from seeking professional advice when necessary. A financial advisor can help you create a comprehensive plan, especially as your assets and goals become more complex. According to a 2025 forecast from Schwab Intelligent Portfolios, the demand for hybrid advisory models (digital tools with human oversight) is expected to surge, making professional guidance more accessible than ever for complex investment planning.

FAQ: Your First Job Finances Edition

Q1: How much should I save from my first paycheck?

Aim to save at least 20% of your net income, following the 50/30/20 rule (20% for savings/debt repayment). However, even starting with 5-10% is excellent. The key is to start consistent saving habits immediately, perhaps by automating a transfer to a separate savings account. Prioritize building an emergency fund first, then consider debt repayment and investing.

Q2: What's the fastest way to pay off student loans?

The "debt snowball" (paying off smallest loans first for psychological wins) or "debt avalanche" (paying highest-interest loans first for maximum savings) methods are effective. Beyond these, consider refinancing if you have good credit for a lower interest rate, or making extra payments whenever possible, like using bonuses or tax refunds. Every extra dollar helps.

Q3: Is it too early to start investing in my first job?

Absolutely not! Starting early is one of the most significant advantages you have. Thanks to compound interest, even small investments made in your twenties can grow substantially over decades. Prioritize contributing enough to your employer's 401(k) to get the full company match, then consider a Roth IRA. Time in the market truly beats timing the market.

Q4: How can I improve my credit score as a young professional?

The best ways to build a good credit score are to pay all your bills on time, keep your credit utilization low (ideally below 30% of your credit limit), and avoid opening too many new accounts at once. Consider getting a secured credit card if you have no credit history, or becoming an authorized user on a trusted family member's card.

Conclusion: Your Journey to Financial Independence Begins Now

Navigating your first job finances is a pivotal step towards a secure and prosperous future. By understanding your income, mastering budgeting, proactively tackling debt, and embracing smart saving and investing strategies, you're not just managing money; you're building a foundation for lifelong financial well-being. Remember, consistency and discipline are your most valuable assets. Your financial journey is a marathon, not a sprint, and every smart decision you make now will compound into significant benefits later.

We encourage you to share your experiences and questions in the comments below. What financial tips helped you most when starting out? For further reading and to continue expanding your financial knowledge, explore more articles about making smart investment choices and consider subscribing to our newsletter for the latest insights in income optimization and personal finance.

Extended Reading Suggestions:

- Budgeting strategies for beginners

- Investing for young adults: a starter guide

- Maximizing your income with side gigs