Repairing Bad Credit: Practical Steps to Improve Your Score and Open New Opportunities

Repairing Bad Credit: Practical Steps to Improve Your Score and Open New Opportunities

Having bad credit can feel like a heavy anchor, holding back your financial aspirations and limiting your access to crucial opportunities. From securing a loan for a home or car to simply getting approved for a new apartment or a competitive interest rate on a credit card, a low credit score presents significant hurdles. The good news is that repairing bad credit is not only possible but also a journey many successfully undertake. It requires understanding how credit scores work, committing to consistent positive financial habits, and adopting strategic approaches to debt management.

This comprehensive guide will walk you through the practical steps you can take to not just incrementally improve your credit score, but to fundamentally transform your financial standing. We'll explore actionable strategies, provide unique insights, and equip you with the knowledge to rebuild your credit and unlock a world of new financial possibilities. The journey begins with a clear understanding and a focused plan, paving the way for a more secure and opportunity-rich future.

Key Points for Repairing Bad Credit:

- Understand your credit report and scoring factors.

- Prioritize timely payments and reduce credit utilization.

- Strategically manage existing debts and avoid new unnecessary ones.

- Be patient and consistent; credit repair is a marathon, not a sprint.

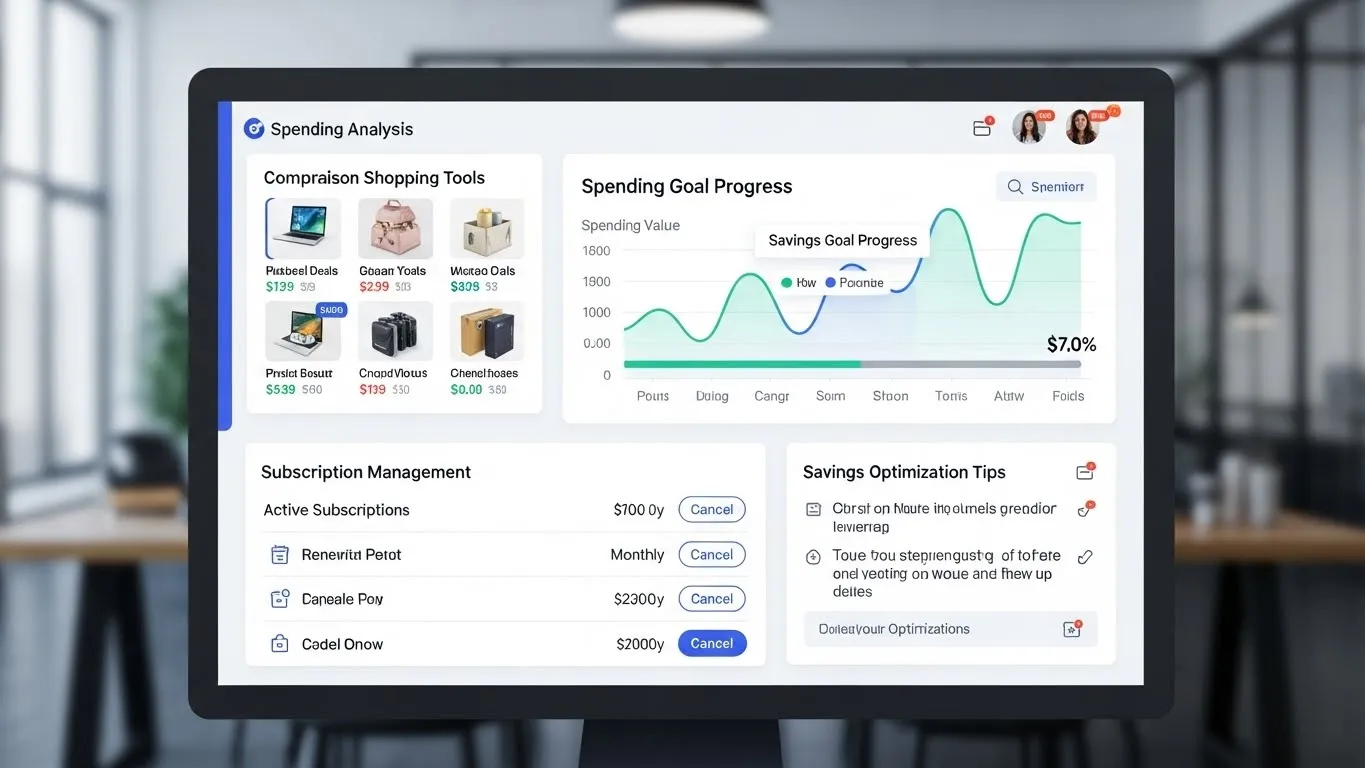

- Leverage professional advice and modern tools when necessary.

Understanding Your Credit Score and Report: The Foundation for Repairing Bad Credit

Before you can effectively begin repairing bad credit, you must first understand its current state. Your credit score is a numerical representation of your creditworthiness, primarily influenced by the information in your credit report. This report details your borrowing history, payment patterns, and various financial accounts. Familiarizing yourself with these documents is the foundational step.

How Your Credit Score is Calculated

Credit scores, like FICO and VantageScore, analyze several key factors to determine your numerical rating. While the exact weighting can vary, the core components remain consistent.

- Payment History (35%): This is the most crucial factor, reflecting whether you pay your bills on time. Late payments significantly harm your score.

- Amounts Owed (30%): This includes your total debt and, importantly, your credit utilization ratio—how much credit you're using compared to your total available credit. Keeping this below 30% is generally advised.

- Length of Credit History (15%): The longer your credit accounts have been open and in good standing, the better.

- New Credit (10%): Opening too many new accounts in a short period can signal risk.

- Credit Mix (10%): A healthy mix of different credit types (e.g., installment loans, revolving credit) can be beneficial.

Understanding these components allows you to prioritize your actions. For instance, consistently making on-time payments will have the most significant positive impact over time.

Obtaining and Reviewing Your Credit Report

You are entitled to a free copy of your credit report from each of the three major bureaus—Experian, Equifax, and TransUnion—annually. Websites like AnnualCreditReport.com provide a centralized access point. Thoroughly reviewing these reports is critical for identifying inaccuracies that could be unfairly dragging down your score.

Look for:

- Accounts that don't belong to you.

- Incorrect payment statuses.

- Outdated negative information (most negative items fall off after 7 years, bankruptcy after 10).

- Incorrect personal information.

Identifying errors is a tangible and often immediate way to begin improving your score. A report from the Consumer Financial Protection Bureau (CFPB) in 2024 highlighted that millions of consumers still find errors on their credit reports, underscoring the importance of regular review.

Strategic Steps for Improving Your Credit Score

Once you understand your credit profile, you can implement targeted strategies. Improving your credit score involves a blend of disciplined financial habits and proactive measures.

1. Prioritize On-Time Payments

As the largest factor in your credit score, consistent on-time payments are non-negotiable. Even a single 30-day late payment can drop your score by tens of points.

- Automate Payments: Set up automatic payments from your bank account or through your creditor's portal. This removes the risk of forgetting due dates.

- Set Reminders: Use calendar alerts or apps to remind you a few days before each payment is due, giving you time to ensure funds are available.

- Pay More Than the Minimum: While not directly affecting your score, paying more than the minimum reduces your principal balance faster, thus decreasing amounts owed and saving on interest.

2. Reduce Credit Utilization

Your credit utilization ratio (CUR) is the amount of credit you're using compared to your total available credit. Financial experts, including data released by Equifax in late 2023, consistently recommend keeping your CUR below 30%, with under 10% being optimal for the best scores.

To reduce your CUR:

- Pay Down Balances: Focus on paying down high-interest credit card debt first.

- Request a Credit Limit Increase: If you have a good payment history, asking for an increase can lower your CUR without increasing your debt (be disciplined not to use the new credit).

- Avoid Closing Old Accounts: An old, unused credit card still contributes to your available credit, helping your CUR.

3. Tackle Existing Debts Strategically

Bad credit repair strategies often involve a focused approach to debt reduction. Prioritize high-interest debts first using methods like the "debt snowball" (paying smallest debts first for motivational wins) or "debt avalanche" (paying highest interest first to save money).

- Negotiate with Creditors: If you're struggling to pay, contact your creditors. They may be willing to work with you on a payment plan, temporarily reduce interest rates, or even settle for a lower amount if you can pay a lump sum.

- Consider Debt Consolidation: For multiple high-interest debts, a debt consolidation loan (if you qualify) or a balance transfer credit card could simplify payments and potentially lower your interest rate. Be cautious, as these don't eliminate debt, only restructure it.

4. Dispute Credit Report Errors

As mentioned, errors can unfairly depress your score. If you find discrepancies, dispute them immediately with the credit bureau and the information provider.

- Gather Evidence: Collect any documents that support your claim (e.g., bank statements, payment confirmations).

- Write a Clear Letter: Explain the error clearly and include copies of your supporting documents.

- Follow Up: Keep records of your communication and follow up if you don't hear back within 30-45 days.

This proactive step can yield surprisingly quick improvements for your overall financial health. For more detailed guidance on managing your money, you might find valuable insights in our article on budgeting for beginners.

Opening New Opportunities Through Credit Rebuilding

Once you embark on the path of repairing bad credit, you're not just fixing a number; you're actively opening doors to better financial products and terms.

Secured Credit Cards and Credit Builder Loans

If you have very poor credit, traditional credit products might be out of reach.

- Secured Credit Cards: These require a cash deposit, which acts as your credit limit. They report to credit bureaus, allowing you to build positive payment history.

- Credit Builder Loans: Offered by some credit unions and community banks, you make payments into a savings account, and once paid off, you receive the lump sum. This builds payment history without immediate access to borrowed funds.

These tools are specifically designed to help individuals with limited or damaged credit establish a positive track record.

The Role of Financial Education and Long-Term Planning

Beyond specific tactics, continuous financial education is paramount. Understanding concepts like debt-to-income ratio is crucial for long-term financial health and credit improvement. You can deepen your knowledge on such topics by reading our comprehensive guide on understanding your debt to income ratio. Moreover, creating and sticking to a detailed budget, found in the Smart Spending and Frugal Living category, helps manage spending and allocate funds effectively towards debt reduction and savings. In my experience, the psychological shift from feeling defeated by debt to actively managing it is one of the most powerful aspects of credit repair.

Differentiated Insight: While speed is often desired, sustainable credit repair focuses on building habits rather than quick fixes. Relying on "credit repair companies" without understanding the underlying issues yourself can be risky. Many simply do what you can do yourself for free, or worse, engage in unethical practices. A study by a major credit reporting agency in late 2024 noted that personalized, consistent effort yields the most durable results. Focus on educating yourself and taking direct action.

Frequently Asked Questions About Credit Repair

Q1: How long does it typically take to repair bad credit? A1: The timeline for credit repair varies significantly based on the severity of the damage and your commitment to positive habits. Minor issues might resolve in 6-12 months, while extensive damage, like a bankruptcy, could take 2-5 years or more to substantially improve your score. Consistency in making on-time payments and reducing debt are the fastest drivers of positive change. Be patient, as good credit is built over time.

Q2: What is the fastest way to improve my credit score? A2: There isn't a single "fastest" way, but focusing on high-impact actions yields quicker results. Paying down high credit card balances to reduce your credit utilization (ideally below 10-30%) can show an immediate improvement once reported to bureaus. Additionally, correcting any errors on your credit report can provide a quick boost. Always prioritize timely payments, as a single missed payment can quickly negate other efforts.

Q3: Does paying off old collections accounts help my credit score? A3: Paying off old collections can help, but the impact varies. The account will still appear on your report, often for up to seven years. However, a "paid" collection looks better to lenders than an "unpaid" one. Sometimes you can negotiate a "pay-for-delete" arrangement, where the collection agency agrees to remove the item from your report upon payment, which offers the most significant positive impact.

Q4: Should I use a credit repair company? A4: Credit repair companies can be helpful for those who lack the time or confidence to dispute errors themselves. However, be cautious. Many companies charge high fees for services you can perform for free. Research their reputation, avoid those promising overnight fixes, and ensure they don't ask for payment upfront before services are rendered, which is illegal. Empowerment through self-education is often the best approach.

Conclusion: Your Path to Financial Freedom

Repairing bad credit is a journey that demands discipline, patience, and a commitment to sound financial practices. It’s more than just improving a number; it's about regaining control over your financial life and opening doors to opportunities you might have thought were out of reach. By understanding your credit report, making timely payments, managing your debt strategically, and leveraging available tools, you can systematically rebuild your credit score.

Remember, every small positive step contributes to significant long-term gains. Don't be discouraged by setbacks; learn from them and stay focused on your goal. Take action today to review your credit report and begin implementing these practical steps. Your future self, with access to better interest rates, loan approvals, and increased financial stability, will thank you.

We encourage you to share your credit repair journey in the comments below or ask any questions you may have. For more tips on managing your finances wisely, explore other articles in our Smart Spending and Frugal Living category.

Further Reading Suggestions:

/articles/budgeting-for-beginners-smart-strategies-for-financial-success/articles/understanding-your-debt-to-income-ratio-a-comprehensive-guide

Expandable Related Subtopics for Future Updates:

- The impact of AI and machine learning on future credit scoring models.

- Advanced strategies for negotiating with collection agencies.

- The role of alternative data in credit assessments for underserved populations.